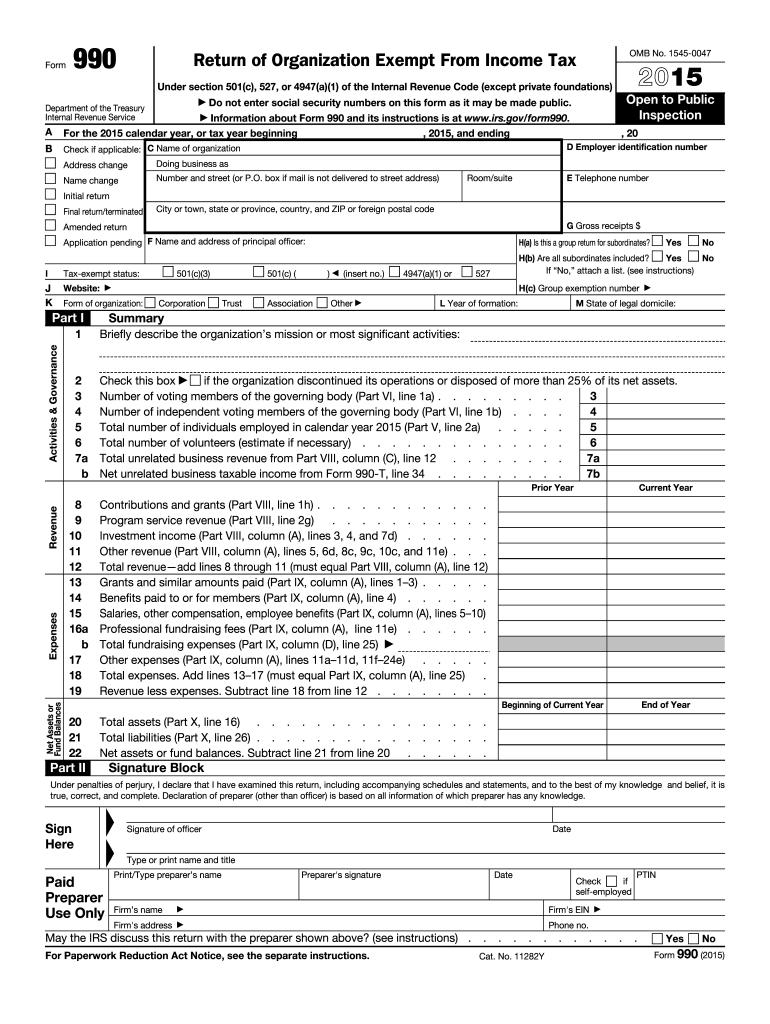

IRS 990 2015 free printable template

Instructions and Help about IRS 990

How to edit IRS 990

How to fill out IRS 990

About IRS previous version

What is IRS 990?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990

What should I do if I realize I've made an error on my IRS 990 after submitting it?

If you discover an error on your submitted IRS 990, you should file an amended return using Form 990-X. This allows you to correct inaccuracies. Be sure to explain the changes and keep documentation of the original and amended forms for your records.

How can I check the status of my submitted IRS 990?

To verify the status of your submitted IRS 990, you can use the IRS online tools available for tracking submissions. Additionally, if e-filing, you may receive a confirmation email that indicates your submission was successful or flagged for correction.

What are some common mistakes to avoid when filing the IRS 990?

Some frequent mistakes include incorrect financial data entries, failing to include required schedules, and not adhering to submission deadlines. To prevent these issues, double-check all entered information and consult guidelines specific to the IRS 990 form.

Can a nonresident or foreign entity file an IRS 990?

Yes, foreign entities may need to file an IRS 990 if they have a presence in the U.S. or meet certain income thresholds. It's important to understand the specific filing requirements and possible compliance implications for foreign payees.

What should I do if my IRS 990 gets rejected after e-filing?

If your IRS 990 is rejected after e-filing, review the rejection notification for specific error codes or issues cited. Correct the mentioned errors promptly and re-submit the form to ensure compliance with IRS regulations.

See what our users say